Disruption Fund

- November 8, 2021

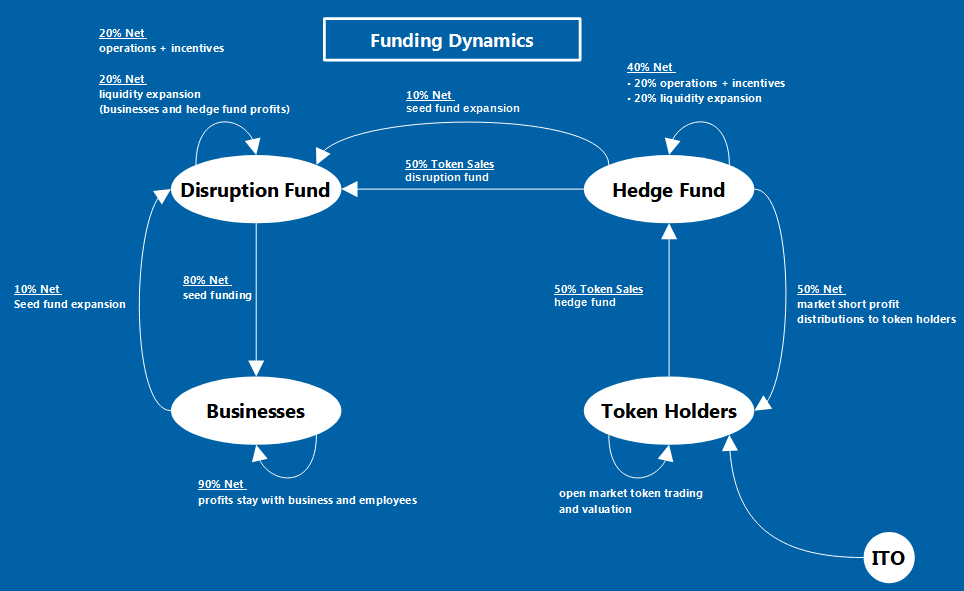

The tricky bit is finding the holes the legal system for the financial issues and getting the masses to buy in enough to seed the fund. I don’t have enough background in that area to do that, but a friend of mine is working on that with someone who works in the hedge fund industry.

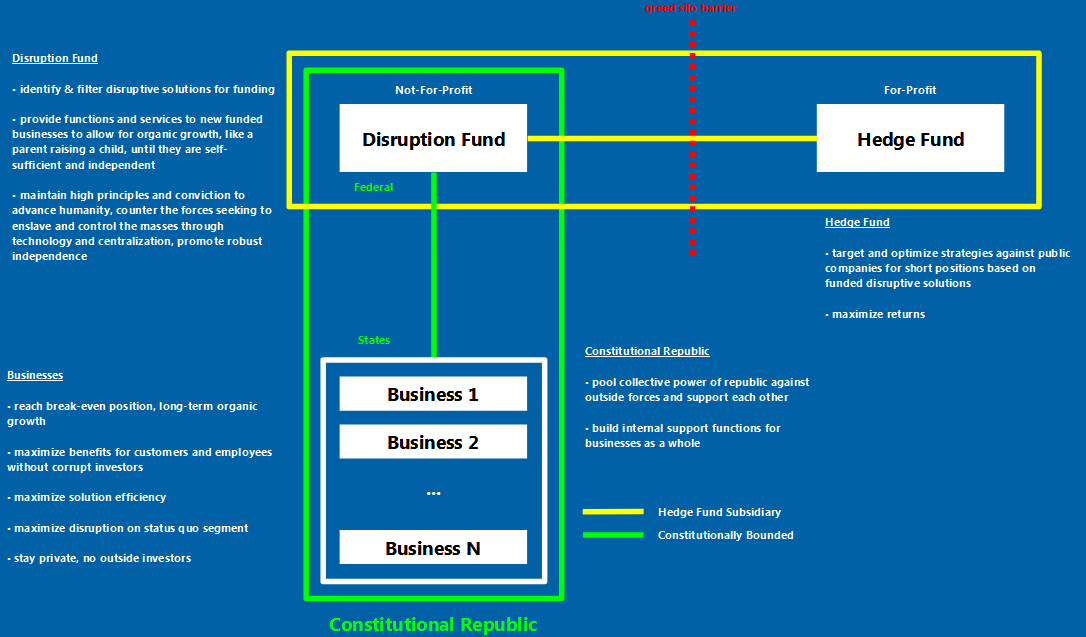

That’s why there’s a “greed silo barrier”. It allows the hedge fund side to maximize returns and fully leverage greed, but it prevents the republic of businesses from being corrupted by investors/stakeholders. They aren’t even in the equation and have no vectors in which to inject control.

If this model works and the positive feedback loop works, then not only will this republic of businesses stay completely private, it means that there will be less businesses in the stock market while simultaneously disrupting them and their revenue/valuations.