The Accounting Equation

To build robust financial systems it’s necessary to have a robust Standard Business Reporting Model

EQ(t)=AS(t)+LB(t)

Qualifications:

- Following a strict sign rule, I prefer writing EQ(t)=AS(t)+LB(t) (instead of EQ(t)=AS(t)-LB(t) which of course is also OK following the traditional sign rule.) I have discussed these rules with Andrew in some depth.

This means, we have a consistent sign rule first on the direction of cash-flows and derived from that on the level of the assets, liabilities and off-balance sheet items.

Having the correct signs at the level of the assets and liabilities makes the whole system strictly additive in the sense, that we can be sure, that we can always use “add” or “+” when aggregating which avoids a lot of confusions and errors.

Also the following equations will turn into strict “+” statements, as soon as the sign rule is strictly implemented. - To be more complete I would write yet EQ(t)=AS(t)+LB(t)+OBS(t) which include the off-balance sheet section, which under today’s rules also must be valued, which means the value is most likely not zero wherefore it becomes part of equity.

- What is called “gains” and “losses” represents in my equations “deltaPD” with the appropriate sign (in the equations the “delta” is represented by the Greek letter, which is not part of this font).

Having agreement on these three qualifications, it is possible to translate my accounting equations into Charlie’s system.

Having such a system based on ACTUS, we have the possibility to calculate

- The value of all assets and liabilities and off-balance sheet positions under multiple valuation regimes (IFRS and multiple local GAAPS) in a consistent manner (you get different PD’s for each valuation regime, the cash-flows are always the same)

- This gives us equity in multiple valuation regimes in a consistent manner

- Investment and distributions to owners are observed variables and can (must) be added

- Comprehensive Income I prefer calling profit but this is just a naming convention:

- Gains and losses can be directly derived from the financial contract. It is simply deltaPD.

- Revenue and expense are the directly observable and can (must) be added

We need just to mention yet, that “operational items” in the balance sheet (as opposed to financial contracts) such as machinery, inventory etc. can (and must) be also represented mathematically in such a system. Say I buy a machine for X and I write it off over a certain number of years following one of the accepted formulas such as linear, geometric or a given schedule, then it is possible to treat them exactly the same way as financial contracts. This makes it possible to represent the entire balance sheet by mathematically defined contracts and derive the entire P&L consistently as described above.

Btw, this does not exclude the possibility of changing such write-off equations as time passes by in a “manual fashion”. Any change will lead to a deltaPD and then it will continue as defined above. The same holds for credit provisioning for financial contracts.

All of this is completely supported by the FASB per SFAC 8.

This is not articulated “cleanly” in SFAC 8, but all of this information is there. This would NEVER be used in an actual financial report; HOWEVER it would be used to support, prove, and verify information represented in the US GAAP XBRL Taxonomy. Now, this can be IMPROVED vastly, and WILL BE IMPROVED by the FASB eventually but by the MARKET before the FASB gets their heads around this. I ask you this with the following question: For this use case for an NFT, WHY would you need ANY ACCOUNTANT to verify this? It is verified by the FASB.

- The following terms are defined by the FASB in SFAC 8 Chapter 4: Assets, Liabilities, Equity, Comprehensive Income, Investments by Owners, Distributions to Owners, Comprehensive Income, Revenues, Expenses, Gains, Losses.

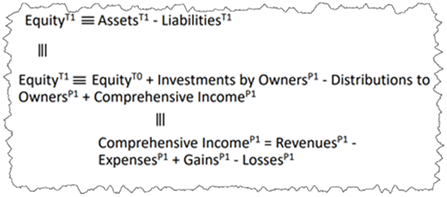

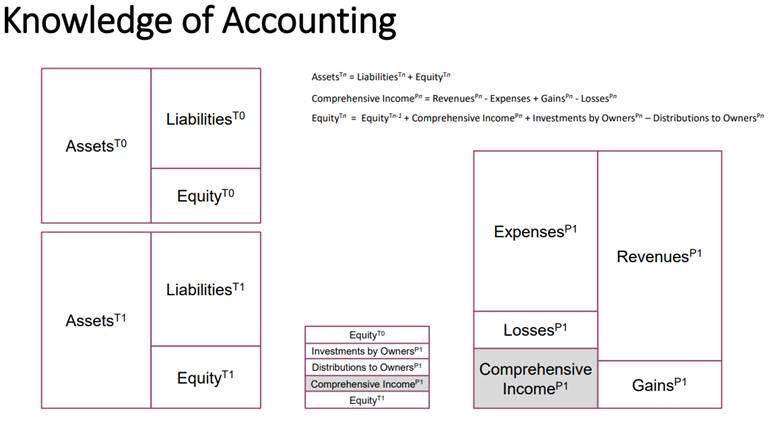

- There are THREE equations that express the relations between these concepts:

- Per Willi (this is his model which I agree with) and using the basic “axioms” or rules of mathematics (or maybe arithmetic); those three equations can be converted into the following three interrelated logical statements: (also, this is the notion of “articulation” as defined by the FASB in SFAC 8 Chapter 7 Presentation)

This is how Willi represents this graphically (I took another example, copied this, and then came up with the following graphic):

- Comprehensive Income = Income from Normal Activities of Entity + Income from Peripheral or Incidental Transactions of Entity

Here is a ZIP archive that contains all the XBRL files:

Pacioli, XBRL Cloud, UBmatrix XPE, Arelle, and Pesseract all say that the XBRL is perfect.

WHY THEN would you not want to be the first in the world to publish an NFT, perhaps THIS NFT for SFAC 8 as contrast to the accounting equation?

IF NOT THIS, THEN WHAT???????? You COULD put this on the Auditchain web site, but on my web site this comes across as more “independent”. Again, this really would not every be used by say a US GAAP or IFRS report; it is more useful for discussing the XBRL taxonomy creation.

Why are you waiting? You want to be second, or third, or forth?

Any accountants have any specific disagreements with the logic of the information provided in the above?